2003-01-23 10:53

KCTA being ready for the 21st century

In the late 1980s, the Port of Busan suffered from extremely heavy demurrage and detentions, failing to handle snowballing container cargoes in the wake of wharf shortage. With such delays, global carriers have been reluctant to call at Busan and have connected to Busan through feeder services, which caused excessive logistic costs and low competitiveness in overseas exports for Korean traders. Building more container wharves seemed inevitable.

However, the government couldn?t meet wharfage requirements for the eye-popping increase of containers with government financial assistance, nor with re-investment of port incomes in port constructions.

Against urgent demand to build container wharves, the Korea Container Terminal Authority (KCTA) was born on April 3, 1990 under the ?Korea Container Terminal Authority Act?enacted on December 30, 1989. It was established to help smooth the distribution of container cargoes by unifying domestic port development, management and operation in Korea. Since its birth, it has successfully constructed the Gamman terminal, Uam Terminal, Singamman terminal in the Port of Busan and Phase I wharf and Phase 2 - 1 wharf in the Port of Gwangyang, adding 20 berths, 12 in Busan and 8 in Gwangyang, to accommodate around 4 million TEUs of additional cargoes. It is also sparing no effort to continuously develop the Phase 2-2 and 3 wharf in the Port of Gwangyang and its hinterland development.

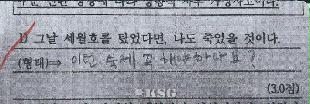

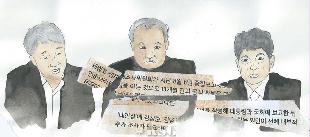

The Korea Shipping Gazette met with Mr. Nam-il Cho, president and CEO of KCTA, to find out about future plans for Korean terminals.

- Korea Shipping Gazette (KSG): Glad to meet you, Mr. Cho. Could you explain, at first, the main projects related with container wharves and facilities that the KCTA promoted in 2002?

Mr. Cho: During the short history of 12 years since its establishment in 1990, the KCTA has produced 20 berths for container wharves, completely solving detention and demurrage problems. Especially, in 2002, KCTA finished the construction of Singamman terminal launched from 1995 and Phase 2-1 wharf in the Port of Gwangyang, 7 berths in total.

Phase 2-2 wharf in Gwangyang is under construction and is scheduled for completion this year and has secured 116,000 pyoung (35,000 square meters) of port related grounds. Phase 3-1 wharf in Gwangyang also started construction in 2002.

Also in 2002, a one berth addition project in the Pusan East Container Terminal (PECT) and Pusan New Port project have been under consideration with likely investment .

- KSG: Where is the KCTA investing now? Could you explain in more detail about PECT coming under private management?

Mr. Cho: The KCTA is investing in the PECT with a 25% share, Yangsan ICD Co., with a 10% share, Korea Logistic Network with 24.68%, Korea Port Technology Co., with 49% and Pusan New Port Co., with a 9% share.

Now, the KCTA is looking to form a joint?venture, investing together with P&O Nedlloyd and PECT on the construction of one more berth in PECT. This project will help PECT to secure cargoes from global shipping carrier as well as increase terminal capacities.

- KSG: Yangsan ICD is a little far away from the Port of Busan, causing extra time and money. As an investor, what do you think of making it more competitive?

Mr. Cho: Yangsan ICD was formed to solve Busan downtown heavy traffic jams and to rationalize logistic flow in the Port of Busan by moving 32 container yards scattered across downtown Busan into the outskirts of Busan.

Yangsan ICD, capable of receiving 1.42 million TEUs of cargoes annually on an area of 383,000 pyoung (116,000 square meters), is handling 1 million TEUs of cargoes now, or about 72% of its potential capacity. Additional costs, 15,000 won per truck, for shuttle charges and toll gate fees, cause shippers to avoid using Yangsan ICD.

After several discussions with the Ministry of Maritime Affairs and Fisheries (MOMAF) and the City of Busan, the KCTA received affirmative responses regarding the exemption of toll gate fees from the City of Busan. The KCTA is also trying to free containers through Yangsan ICD from container taxes temporarily until 2006.

-KSG: Including Korea, several countries in Northeast Asia have been heavily developing ports, aiming for hub port status in the area. The point is that who and how fast will they develop ports to handle expected cargoes? So, what is your future plan to develop container ports in Korea?

Mr. Cho: To be the major hub port in Northeast Asia, we need to equip port facilities enough to handle domestic cargoes and to draw cargoes from neighboring countries. To this end, the KCTA has developed 8 berths in the port of Gwangyang and will add 25 berths more through the development project of phase 2-2, phase 3 and phase 4 in Gwangyang. At the end, Gwangyang will have 33 berths in total by 2011 to handle 9.13 million TEUs of cargoes. And by involving the Pusan New Port project with investment on 8 berths, the KCTA is fully ready for the coming future.

-KSG: Building container terminals requires huge amounts of capital. How do you usually support these construction plans?

Mr. Cho: To build terminals, we, first of all, could use rent fees from terminal leases and then garner further funding from private capital by issuing bonds, loans, and issuing Foreign Securities. Thanks to our excellent credit, the KCTA is raising money with favorable interest rates, 5% lower than the commercial interest rate.

For the aforementioned financing, however, it couldn?t satisfy the complete required funds wholly. Therefore, from 2002, the government is supporting the KCTA with 30 billion won. Next year, we are expected to receive 40 billion won. The KCTA is supposed to have support from the government for around 30% of port investment costs.

-KSG: I think it seems to be absolutely nesessary to build container terminals linked with Information Technology (IT). Considering the high cost of human labor, port automation also seems to be urgent, as well. Do you have any plans or thoughts about this?

-Mr. Cho: The KCTA has been considering various countermeasures for domestic ports to enhance international competitiveness through highly efficient port operation. As a matter of fact, many domestic container ports have been automated to handle cargoes. Especially, the KCTA is focusing on developing wholly automated terminals.

Based on construction plans in 1997, the KCTA is pushing to build the phase 3-2 wharf in the port of Gwangyang as a state-of-the-art unmanned automated container terminal, and has scheduled construction of three berths by 2008.

After successfully completing this plan, this automation technology will be adopted on another domestic ports and finally, export the skills and know-how to overseas.

-KSG: It?s been a pleasure talking to you today, and thank you for your time.

.

However, the government couldn?t meet wharfage requirements for the eye-popping increase of containers with government financial assistance, nor with re-investment of port incomes in port constructions.

Against urgent demand to build container wharves, the Korea Container Terminal Authority (KCTA) was born on April 3, 1990 under the ?Korea Container Terminal Authority Act?enacted on December 30, 1989. It was established to help smooth the distribution of container cargoes by unifying domestic port development, management and operation in Korea. Since its birth, it has successfully constructed the Gamman terminal, Uam Terminal, Singamman terminal in the Port of Busan and Phase I wharf and Phase 2 - 1 wharf in the Port of Gwangyang, adding 20 berths, 12 in Busan and 8 in Gwangyang, to accommodate around 4 million TEUs of additional cargoes. It is also sparing no effort to continuously develop the Phase 2-2 and 3 wharf in the Port of Gwangyang and its hinterland development.

The Korea Shipping Gazette met with Mr. Nam-il Cho, president and CEO of KCTA, to find out about future plans for Korean terminals.

- Korea Shipping Gazette (KSG): Glad to meet you, Mr. Cho. Could you explain, at first, the main projects related with container wharves and facilities that the KCTA promoted in 2002?

Mr. Cho: During the short history of 12 years since its establishment in 1990, the KCTA has produced 20 berths for container wharves, completely solving detention and demurrage problems. Especially, in 2002, KCTA finished the construction of Singamman terminal launched from 1995 and Phase 2-1 wharf in the Port of Gwangyang, 7 berths in total.

Phase 2-2 wharf in Gwangyang is under construction and is scheduled for completion this year and has secured 116,000 pyoung (35,000 square meters) of port related grounds. Phase 3-1 wharf in Gwangyang also started construction in 2002.

Also in 2002, a one berth addition project in the Pusan East Container Terminal (PECT) and Pusan New Port project have been under consideration with likely investment .

- KSG: Where is the KCTA investing now? Could you explain in more detail about PECT coming under private management?

Mr. Cho: The KCTA is investing in the PECT with a 25% share, Yangsan ICD Co., with a 10% share, Korea Logistic Network with 24.68%, Korea Port Technology Co., with 49% and Pusan New Port Co., with a 9% share.

Now, the KCTA is looking to form a joint?venture, investing together with P&O Nedlloyd and PECT on the construction of one more berth in PECT. This project will help PECT to secure cargoes from global shipping carrier as well as increase terminal capacities.

- KSG: Yangsan ICD is a little far away from the Port of Busan, causing extra time and money. As an investor, what do you think of making it more competitive?

Mr. Cho: Yangsan ICD was formed to solve Busan downtown heavy traffic jams and to rationalize logistic flow in the Port of Busan by moving 32 container yards scattered across downtown Busan into the outskirts of Busan.

Yangsan ICD, capable of receiving 1.42 million TEUs of cargoes annually on an area of 383,000 pyoung (116,000 square meters), is handling 1 million TEUs of cargoes now, or about 72% of its potential capacity. Additional costs, 15,000 won per truck, for shuttle charges and toll gate fees, cause shippers to avoid using Yangsan ICD.

After several discussions with the Ministry of Maritime Affairs and Fisheries (MOMAF) and the City of Busan, the KCTA received affirmative responses regarding the exemption of toll gate fees from the City of Busan. The KCTA is also trying to free containers through Yangsan ICD from container taxes temporarily until 2006.

-KSG: Including Korea, several countries in Northeast Asia have been heavily developing ports, aiming for hub port status in the area. The point is that who and how fast will they develop ports to handle expected cargoes? So, what is your future plan to develop container ports in Korea?

Mr. Cho: To be the major hub port in Northeast Asia, we need to equip port facilities enough to handle domestic cargoes and to draw cargoes from neighboring countries. To this end, the KCTA has developed 8 berths in the port of Gwangyang and will add 25 berths more through the development project of phase 2-2, phase 3 and phase 4 in Gwangyang. At the end, Gwangyang will have 33 berths in total by 2011 to handle 9.13 million TEUs of cargoes. And by involving the Pusan New Port project with investment on 8 berths, the KCTA is fully ready for the coming future.

-KSG: Building container terminals requires huge amounts of capital. How do you usually support these construction plans?

Mr. Cho: To build terminals, we, first of all, could use rent fees from terminal leases and then garner further funding from private capital by issuing bonds, loans, and issuing Foreign Securities. Thanks to our excellent credit, the KCTA is raising money with favorable interest rates, 5% lower than the commercial interest rate.

For the aforementioned financing, however, it couldn?t satisfy the complete required funds wholly. Therefore, from 2002, the government is supporting the KCTA with 30 billion won. Next year, we are expected to receive 40 billion won. The KCTA is supposed to have support from the government for around 30% of port investment costs.

-KSG: I think it seems to be absolutely nesessary to build container terminals linked with Information Technology (IT). Considering the high cost of human labor, port automation also seems to be urgent, as well. Do you have any plans or thoughts about this?

-Mr. Cho: The KCTA has been considering various countermeasures for domestic ports to enhance international competitiveness through highly efficient port operation. As a matter of fact, many domestic container ports have been automated to handle cargoes. Especially, the KCTA is focusing on developing wholly automated terminals.

Based on construction plans in 1997, the KCTA is pushing to build the phase 3-2 wharf in the port of Gwangyang as a state-of-the-art unmanned automated container terminal, and has scheduled construction of three berths by 2008.

After successfully completing this plan, this automation technology will be adopted on another domestic ports and finally, export the skills and know-how to overseas.

-KSG: It?s been a pleasure talking to you today, and thank you for your time.

.

많이 본 기사

- “호르무즈 선원교대 원활…문제 생기면 외교부와 송환 협의”BDI 1919포인트…벌크선 시장, 중동 사태에 긴장 고조HMM, 중동노선 신규예약 중단 및 우회운항‘중동사태 여파’ 컨운임지수 4개월만에 두자릿수 상승해양소년단연맹, 인천 영종도에 국제청소년해양교육원 건립 추진삼성重·샌디에이고주립대, 공동연구센터 개소…한미 조선협력 속도지마린서비스, 선박연비 개선 측정 AI 개발…KR서 개념승인“파나마운하 운영권 무효” 허치슨-파나마정부 분쟁 격화해수부, ‘최대 3억’ 해외 항만 개발 진출 돕는다플로우케이, 광양항 배후단지 물류센터 준공

- 인천항만공사, 소래습지서 갯벌 생태계 복원 나서대한항공, 기내식·기내면세 사업 7500억에 재인수IPA, ‘컨’ 터미널운영사와 화물 반출입시간 단축 방안 논의홍콩 OOCL, 지난해 영업익 2.3조…전년比 42%↓조선해양기자재硏-목포해대, 암모니아 연료공급시스템 기술교류 ‘맞손...롯데글로벌로지스, 강아지의날 맞아 유기견 보호 봉사활동페덱스, 대만 타오위안공항 환적센터 확장한국해양재단 신임 이사장에 김양수 前 차관여수세계박람회장 국제관 입주 사업자 상시모집YGPA, 선박 저속운항 인센티브 지급 완료

스케줄 많이 검색한 항구

0/250

확인